What are the 2008 Tax Brackets?

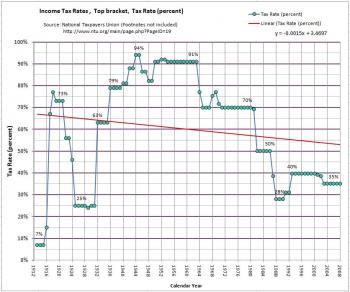

The 2008 tax brackets, like the other tax brackets of the United States progressive tax system increase as income rises. The 2008 tax brackets are percentage tiles; the highest incomes are taxed the highest percentages while the lowest qualifying income bracket is taxed at the lowest percentage. The tax rates and brackets are variable; they are subject to change based on the political party's view on the taxation model.

The 2008 tax brackets, like the other tax brackets of the United States progressive tax system increase as income rises. The 2008 tax brackets are percentage tiles; the highest incomes are taxed the highest percentages while the lowest qualifying income bracket is taxed at the lowest percentage. The tax rates and brackets are variable; they are subject to change based on the political party's view on the taxation model.

Some party's feel as though the highest income brackets deserve tax brackets to initiate a trickle-down effect. Other party's, however, feel as through the tax responsibility should be placed on the highest earners and that the middle to lower income brackets should have their tax percentages lowered to spark savings, consumption and investment.

2008 tax brackets apply only to the income in each tax range. In addition, the tax rates apply only to the entity's taxable income. Various deductions and adjustments all lower taxable income, however, they are not taken into account for tax brackets.

The following tax rates were applied to tax returns only in 2008. This simply means that other taxable years are not relevant for the below figures. Inflation yields an overall increase wages, which in turn, adjusts the subsequent years tax bracket figures. The 2008 tax brackets are as follows (refers to annual income):

10% tax bracket (lowest bracket) applied to income between $0 and $8,025

15% tax bracket applied to income between $8,025 and $32,550 (plus the

$802.50 from the first $8,025 taxed at the 10% level.

25% on income between $32,550 and $78,850; plus $4,481.25

28% on income between $78,850 and $164,550; plus $16,056.25

33% on income between $164,550 and $357,700; plus $40,052.25

35% (highest tax bracket) on income over $357,7000; plus $103,791.75

Related Topics

- Lee County Tax Collectors

- Where to Mail Tax Return

- Difference Between Customs And Excise Taxes

- A Quick Summary to Income Taxes

- Montana State Tax

- The Facts on Tax Law

- Why is Dubai Duty Free

- Make Taxes Easier with Tax Calculators

- Michigan State Tax

- Georgia State Tax